Industry News: Intense Competition in the 2024 Hair Care Market Sparks a Multifaceted Battle!

In 2024, with numerous domestic enterprises entering the market, a new wave of intense competition has begun, drastically increasing the competitive pressure in the hair care market. Notably, the trend towards localization in the hair care market is becoming unstoppable.

In 2024, with numerous domestic enterprises entering the market, a new wave of intense competition has begun, drastically increasing the competitive pressure in the hair care market. Notably, the trend towards localization in the hair care market is becoming unstoppable.

2024 Hair Care Market:

Price Wars and Elimination Rounds

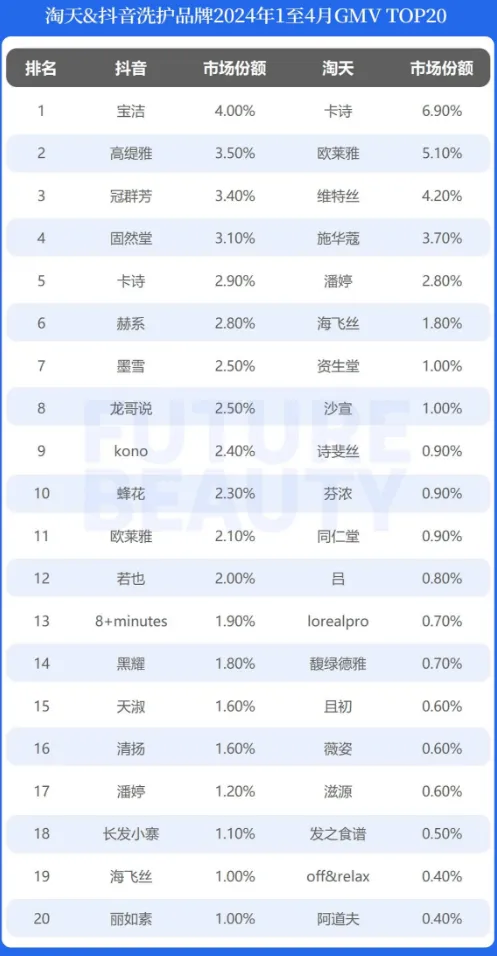

In the first four months of 2024, data from online channels like Taotian, Douyin, and JD.com indicate that China's hair care market has entered a new era.

Firstly, data shows that the hair care segment has entered an "elimination round" mode, with brands fiercely competing for market share.

According to Douyin, from January to April 2024, the number of hair care stores dropped from 27,800 in 2023 to 13,500, a decrease of 63.01%; the number of brands fell from 7,943 in 2023 to 4,380 in 2024; and the number of products decreased from 159,400 in 2023 to 65,300 by April 2024, a year-on-year decline of 44.86%.

This shows that many players in the hair care market have exited, reflecting the intense competition in the 2024 market.

Secondly, as the market enters the elimination round, the focus of competition has shifted to "price wars," with cost-effective products under 100 yuan significantly expanding their market share.

A notable trend is the shift of market share towards products priced below 100 yuan. Both Douyin and Taotian platforms show a trend of expanding sales for products in this price range:

For instance, the proportion of sales under 100 yuan in Douyin's hair care category increased from 50.69% last year to 58.11%. On Taotian, the proportion of hair care products under 100 yuan increased from less than 40% to over 50%. Meanwhile, sales of mid-to-high-priced products (100-200 yuan, 200-400 yuan) on both platforms saw a 4-5 percentage point decline. However, sales of high-end products over 400 yuan remained stable, with a slight decline on Taotian and a slight increase on Douyin.

Comparing the average product prices of the top 10 brands on Taotian in the first four months of 2024 with those in 2023, brands like Kérastase, L'Oréal, Pantene, Schwarzkopf, Head & Shoulders, Vidal Sassoon, and Supaya all saw their average product prices drop by 24%-44%. Douyin showed a similar trend, with both Procter & Gamble and domestic brands like Kono, Fenghua, and Goutiya experiencing a decline in average product prices.

Thirdly, demand for specific effects and refined care is rising—volumizing has become the top selling point, and sales of essential oils and hair masks are growing rapidly.

In terms of functional claims, volumizing, oil control, and smoothing have replaced dandruff prevention, anti-hair loss, and cleansing as the top functional segments.

Additionally, consumer interest in refined hair care is increasing, highlighting the growth potential of conditioners/hair masks and hair oils. From January to April 2024, the GMV of shampoo on Douyin reached 1.89 billion yuan, a year-on-year increase of 28.10%, accounting for nearly 50% of the market. Meanwhile, conditioners/hair masks and hair oils saw the largest sales growth, at 80% and 58% respectively. Notably, scalp care products grew by 11.5% year-on-year, recovering by about 10% from last year.

Fourthly, private labels are rising, leveraging channel advantages.

The rise of Douyin has not only diverted traffic from Taotian but also driven growth in the overall beauty market. The hair care segment grew by 28.4% from January to April 2024, leading all categories. Under Douyin's influence, many private label hair care brands have surged, quickly capturing top 20 market shares. Brands like Goutiya, Guan Qun Fang, Guran Tang, Hersi, and Longge Shuo have emerged rapidly.

Combining these four changes, the competitive intensity in the 2024 hair care market has increased, pushing some competitors out. This competition will likely continue throughout the year. Unlike past marketing or price wars, today's hair care battle involves research and development, efficacy, price, marketing, and innovation—a multifaceted war.

In recent years, several leading domestic groups have launched new brands to enter the hair care segment, including Proya, Shanghai Jahwa, Giant Biogene, and Franic Biotechnology. Both Giant Biogene and Franic Biotechnology are entering the hair care market for the first time. Meanwhile, the main hair care brand under Huanya, Syocean, is upgrading its positioning, focusing on scalp care, and Mask Family is about to launch a new hair care brand.

Notably, driven by these new brands and their parent groups, China's hair care market is accelerating towards a "universal scalp care era."

Chinese enterprises' understanding of hair care products has evolved from basic functions like cleaning, oil control, and dandruff prevention to scalp care. This shift has led to significant changes in their upstream research and development paths and focus areas—from breakthroughs in surfactant systems, functional ingredients, and fragrance to innovative ingredients and formulations aimed at regulating the scalp's micro-ecosystem. This shift will undoubtedly bring a wave of long-term research and innovation to China's hair care market, potentially breaking the technological barriers in advanced efficacy for Chinese hair care brands.

The 2024 6th Shanghai International Hair Care Products Exhibition will be grandly held at the Shanghai New International Expo Center from August 7-9, 2024! It will gather the entire industry chain of hair care companies to showcase cutting-edge new products across the hair care sector, providing one-stop procurement services.

At this stage, the "internal competition" in China's hair care market has become inevitable. However, a larger market scale means more opportunities and challenges, with more new products catering to market changes flooding the market. As the new round of elimination begins, how domestic brands complete their market strategies in this accelerated "window period" will be revealed in time.